Upstart Overview

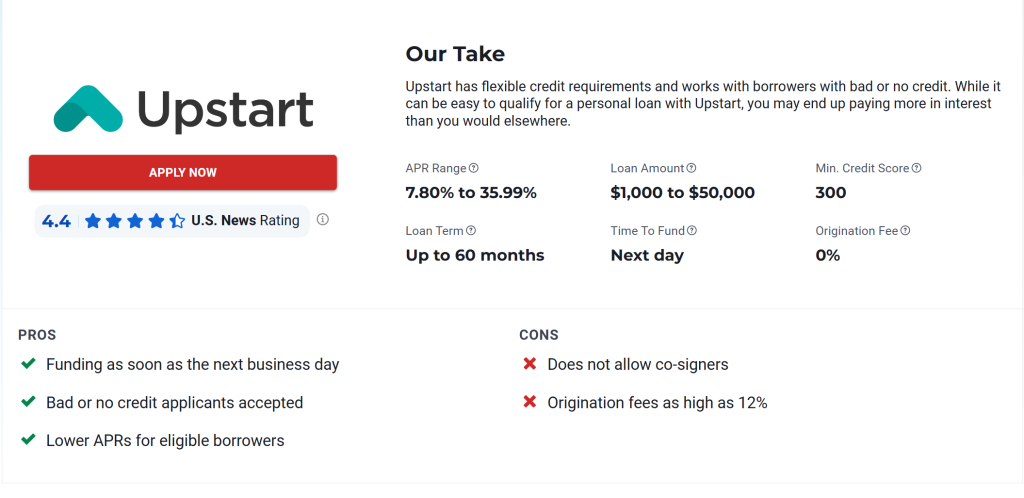

Whereas many lenders require an excellent to superb credit score rating score, Upstart is designed for these with poor credit score rating. It’s possible you’ll borrow between $1,000 and $50,000. Upstart is not going to be a direct lender — it’s a lending market which will match you with eligible banks and credit score rating unions when you apply. Whereas that’s good for evaluating decisions, it would result in texts, emails and phone calls from quite a few lenders.

Professionals

- Can have below-average credit report of 300 or above and nonetheless qualify

- Can get funding inside one enterprise day

- Generous mortgage amount differ compared with these of various bad-credit lenders — between $1,000 and $50,000

- No prepayment penalties

Cons

- Bigger most charges of curiosity than many various lenders — as a lot as a 35.99% annual proportion value (APR)

- Comes with origination expenses, which might differ counting on the lender

- May be inundated with calls, texts and emails

Why Upstart Stands Out

As a lending market, you can presumably uncover loans with quite a few completely completely different lenders by the use of Upstart. Whereas debtors with low credit score rating may revenue from considering Upstart, prospects with superb credit score rating is also increased off with a particular lender that has larger credit score rating score necessities coupled with in all probability lower charges of curiosity.

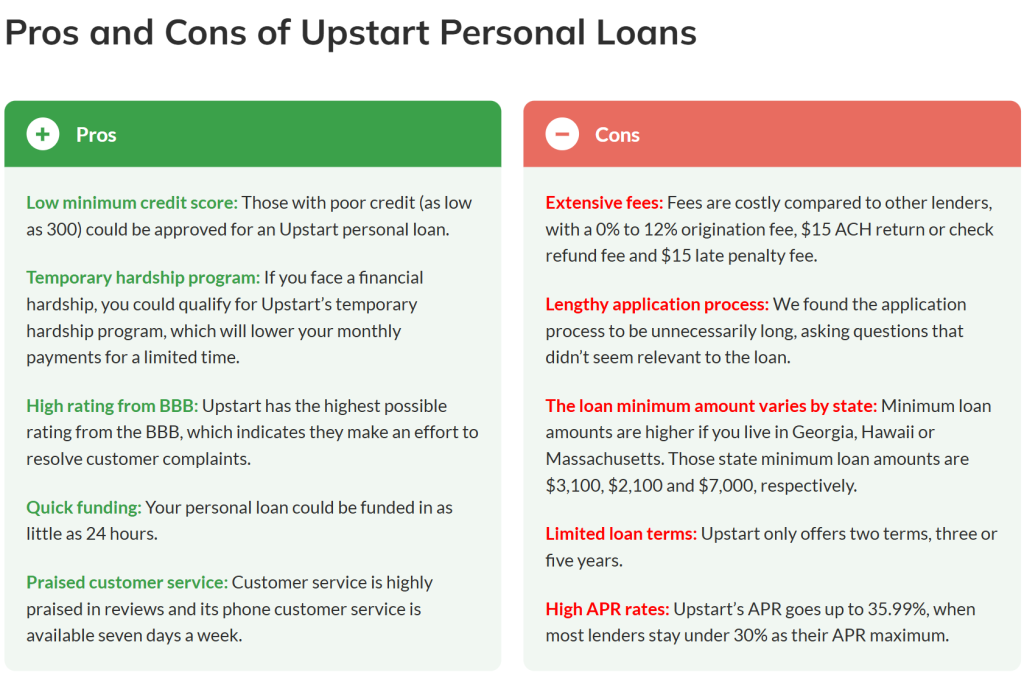

Our Sort out Upstart

Upstart is best for candidates with below-average credit report and provides a short hardship program to lower month-to-month funds do you have to lose your job unexpectedly. Upstart doesn’t promote this program, so we on the MarketWatch Guides group reached out for further data. The advisor acknowledged the momentary hardship program typically lowers funds for as a lot as two pay intervals, and eligibility varies on a case-by-case basis.

Upstart is not going to be the exact lender for personal loans, nonetheless an AI-powered market with fairly a couple of affiliate financial institutions, along with credit score rating unions harking back to Alliant Credit score rating Union.

- Minimal credit score rating score: The minimal credit score rating score is 300 to be accredited for an Upstart mortgage. That’s significantly low compared with completely different lenders.

- Mortgage amount: Upstart non-public mortgage portions differ from $1,000 to $50,000.

- Mortgage time interval: Upstart non-public loans have two reimbursement phrases, three or 5 years.

How We Payment Upstart Non-public Loans

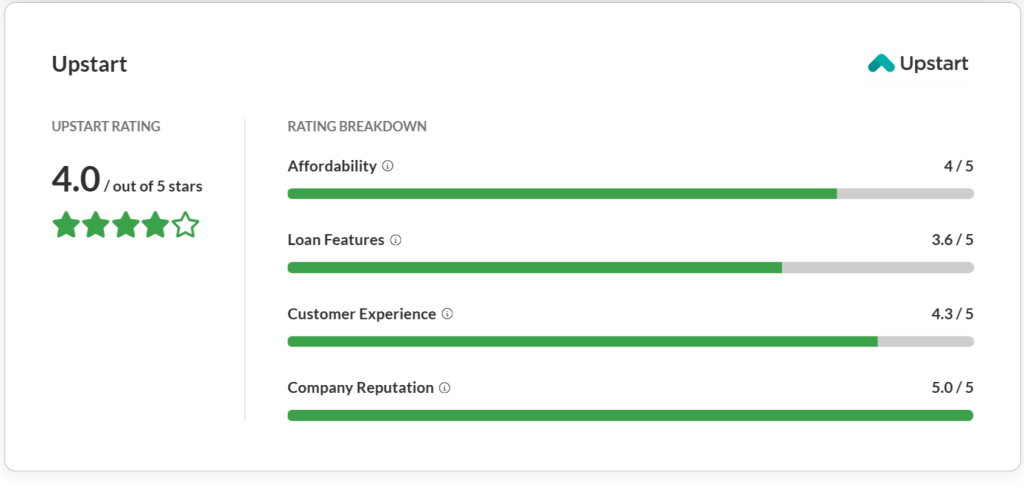

We score Upstart non-public loans 4 out of 5 stars (80 out of 100 elements). The final scoring was calculated from data on 4 foremost lessons: affordability, mortgage choices, purchaser experience and agency reputation. We moreover thought-about choices like the ability to decide on mortgage phrases, potential expenses and expenses.

- Affordability (28/35): Upstart has certainly one of many lowest starting APRs, nonetheless its loans can embody hefty expenses — along with as a lot as a 12% origination cost. Completely different big lenders, like Uncover, don’t value an origination cost the least bit. Whereas there’s no early penalty for paying off your mortgage early, late payment expenses and failed monetary establishment change expenses could also be charged.

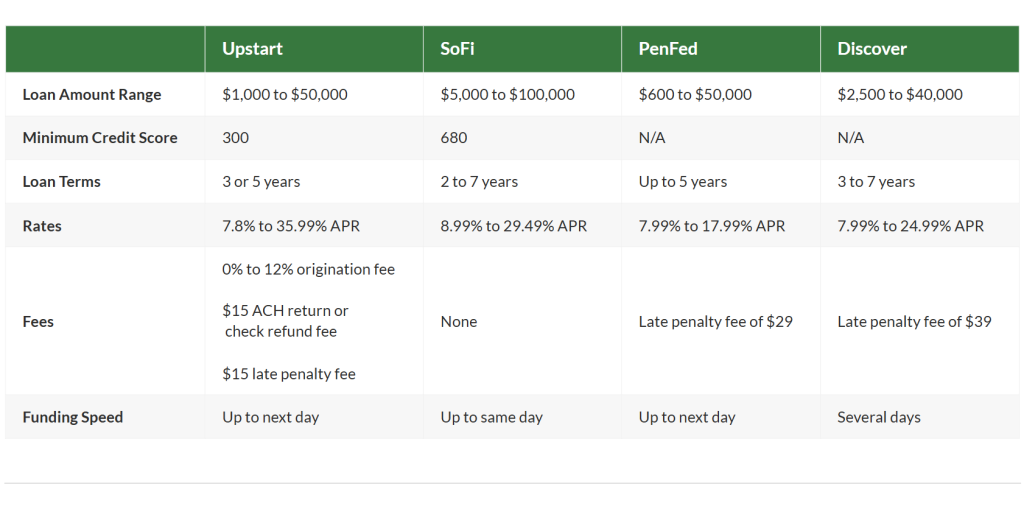

- Mortgage choices (25/35): Compared with completely different lenders, Upstart provides a narrower differ of mortgage phrases and portions. Solely two phrases could be discovered — three or 5 years — with a $50,000 mortgage limit. For comparability, SoFi non-public loans present a diffusion of two to seven years, with a $100,000 mortgage limit.

- Purchaser experience (17/20): Upstart has an outstanding buyer help rating as a consequence of its tender credit score rating study prequalification chance, 50 state availability and seven-days-a-week phone assist.

- Agency reputation (10/10): Upstart has the very best doable rating from the BBB.

One different noteworthy mortgage attribute is Upstart’s quick funding, which can be as rapidly as the next enterprise day. In March 2024, 62% of Upstart prospects obtained their funds inside 24 hours of approval and signing, consistent with Upstart. That’s prior to LendingClub and Axos, which take in any case two enterprise days to fund your mortgage.

In case your mortgage utility is accepted sooner than 5 p.m. on a weekday, your money may be transferred the next enterprise day, the company ensures. In case you compromise in your mortgage after this cutoff, the money may be despatched the following enterprise day. If Upstart requires additional documentation, funding could take longer.

It’s important to note your mortgage minimal may be larger than Upstart’s $1,000 marketed minimal mortgage do you have to reside in Georgia, Hawaii or Massachusetts. These state minimal mortgage portions are $3,100, $2,100 and $7,000, respectively.

Will I Qualify for an Upstart Non-public Mortgage?

You may qualify for an Upstart non-public mortgage in case your credit score rating score is above 300 and your earnings is deemed sufficient to pay once more the mortgage. The following is not going to be an exhaustive file, solely a shortened occasion of elementary Upstart mortgage qualifiers.

You’ll need to fulfill the following elementary eligibility requirements:

- Be in any case 18 years earlier with a legit electronic message cope with

- Have a verifiable title, date of starting and Social Security amount

- Have a non-public banking account at a U.S. financial institution with a routing transit amount

Positive statistics counsel it is easier to qualify for an Upstart non-public mortgage than completely different prime lenders. Better than two-thirds of Upstart loans are accredited instantly and completely automated, consistent with a press launch.

Our First-Hand Experience Making use of for an Upstart Mortgage

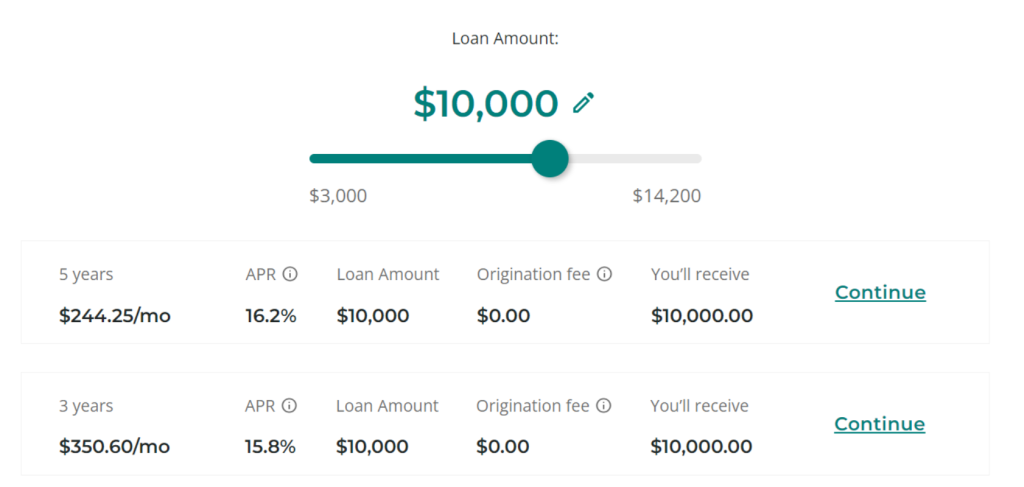

Definitely certainly one of our MarketWatch Guides researchers utilized for an Upstart non-public mortgage of $10,000 with a 759 credit score rating score and obtained expenses of 16.2% APR and 15.8% APR, for a five- or three-year time interval, respectively. Our mortgage did not have an origination cost.

We utilized for the mortgage on May 29 and had until June 11 to resolve. We like that the equipment had an extended acceptance interval so prospects don’t actually really feel rushed to resolve.

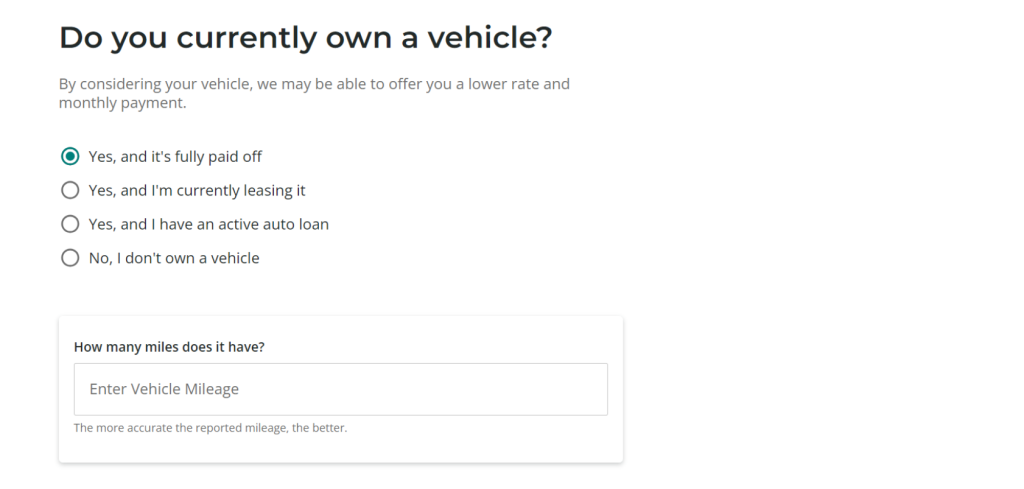

We found the equipment to be unnecessarily in depth. It requested for information like automotive mileage, education diploma, how so much you can have in monetary financial savings or funding accounts, what month and 12 months you started your current job place and when you could have taken out a mortgage all through the earlier three months. This isn’t data most have ready on the fly, which may be very inconvenient. All questions have been required to be answered.

There are completely different points for approval, which we break down beneath.

Credit score rating Ranking and Financial Historic previous

Your credit score rating score should be 300 or above on in any case certainly one of many shopper experiences obtained in connection collectively along with your utility. You’ll need to have a sturdy financial historic previous, and there can’t be any abrupt changes to your credit score rating report or debt historic previous.

Beneath are quite a few parts that may result in your Upstart mortgage being denied:

- Essential drops in your credit score rating score or additional debt obligations.

- Failure to fulfill the minimal debt-to-income requirement of 45% in New York, Maryland, Connecticut or Vermont and 50% in all completely different areas.

- Bankruptcies on any of your shopper experiences all through the ultimate 12 months.

- Six inquiries or further in your credit score rating report throughout the closing six months, not along with any inquiries related to pupil loans, automotive loans, or mortgages

Helpful Tip: You in all probability have good credit score rating (above 680), you may qualify for a SoFi mortgage as a substitute, which has no expenses and a greater mortgage borrowing limit (as a lot as $100,000).

Income and Employment

We found Upstart’s required earnings and employment data to be unnecessarily in depth. Upstart requests your house of study, which doesn’t seem associated to the mortgage, and Upstart states its monetary establishment companions don’t have a minimal tutorial requirement to be eligible for a mortgage.

You’ll need to have some sort of earnings, a job or have accepted a job that you just’d start all through the next six months to qualify. You’ll should enter this data in your mortgage utility. In case you’re salaried, Upstart requests your title, the title of the company you’re employed by alongside collectively along with your start month and 12 months.

Upstart Non-public Loans Evaluations

Our MarketWatch Guides group reviewed 1000’s of opinions from frequent publicly on the market user-review web sites along with Trustpilot, the Greater Enterprise Bureau, Shopper Affairs and Best Agency to offer you an idea of how prospects actually really feel about non-public mortgage companies.

We categorized each evaluation to search out out whether or not or not it was optimistic or hostile. With that data, we normalized scores in direction of each other to create an extraordinary. We generated numeral scores to gauge Upstart’s ease of use, responsiveness, transparency, reliability, and buyer help as a result of it pertains to completely different lenders. Scores do not guarantee your experience and are solely imagined to convey regular developments.

Upstart’s Basic Shopper Sentiment score is 4.3 out of 5 stars, which is optimistic. Beneath, we break down specific particular person scores for Upstart.

- Ease of Use: 4.4

- Responsiveness: 4.3

- Transparency: 4.5

- Perception and Reliability:4.9

- Purchaser Service: 4.8

Most Praised Choices

- Tempo and effectivity of mortgage processing: Prospects applauded the quick and straightforward mortgage course of. Better than half (53%) of optimistic opinions praised the speed of the mortgage course of.

- Helpful purchaser assist: Assist was well-known as accessible and helpful, which improved particular person experience. Better than 20% of optimistic opinions praised Upstart’s buyer help.

Most Widespread Complaints

- Minimal: There have been only some complaints, with an occasional level out of needing further clear communication on specific phrases or circumstances.

Who Are Upstart Non-public Loans Best For?

Upstart non-public loans are best for people with below-average credit report and subsequently a lot much less of a possibility of approval with completely different lenders. Upstart approves loans for debtors with a credit score rating score as little as 300, moreover considering their education and employment.

Edward Sanchez has a poor credit score rating score and needs $10,000 for residence enchancment

Edward’s mortgage is inside Upstart’s mortgage differ and doesn’t menace his residence as collateral as he would with a residence equity line of credit score rating (HELOC). Upstart’s low credit score rating score requirement makes it attainable Edward may be accredited for his mortgage.

Ngyuen Lin wishes to shortly cast off $20,000 in glorious financial institution card debt

Ngyuen’s mortgage request is beneath $50,000, which is inside Upstart’s limits, making him a in all probability eligible candidate. Because of Ngyuen wishes to cast off his debt shortly, he could profit from Upstart’s speedy funding, which can take as little as 24 hours.

How Upstart Compares to Completely different Lenders

Upstart has an extraordinary mortgage amount differ, a low minimal credit score rating score and possibly expensive expenses compared with completely different lenders. Its most APR of 35.99% is considerably extreme, and there are ample expenses to be cautious of.

Whereas PenFed and Uncover have a late penalty cost, Upstart has an origination cost, ACH return cost and late penalty cost. Nonetheless, it’s noteworthy to say not every mortgage is matter to the origination cost. In our sample mortgage, we did not face an origination cost.

Professionals and Cons of Upstart Non-public Loans

Upstart Non-public Loans Utilization Tips

Upstart normally permits you to use your non-public mortgage to cowl most costs, harking back to debt consolidation, medical payments, residence enchancment duties, a switch, a wedding or maybe a visit.

Nonetheless, Upstart doesn’t may help you employ your non-public mortgage as a down payment on a home mortgage mortgage. Lenders typically don’t allow non-public loans to cowl tuition or enterprise payments, nonetheless Upstart didn’t clarify if these restrictions apply to its loans.

We contacted Upstart for clarification, nonetheless the reply was nonetheless unclear. The advisor acknowledged restrictions differ, counting on which mortgage affiliate Upstart arms off your utility to. Once you full your utility, you should be succesful to see if you could use your mortgage to pay for enterprise or tuition costs.